Is There Sales Tax On Electronics In Pa . Act 84 of 2016 specifically applies the commonwealth’s 6 percent sales and use tax to the purchase of digital. While pennsylvania's sales tax generally applies to most transactions,. act 84 of 2016, specifically applies the commonwealth’s 6 percent sales and use tax to the purchase of digital products. the 24 states that are members of the streamlined sales and use tax agreement (ssuta, or sst states). in pennsylvania, they’re exempt from the state’s sales tax. Purchases in the keystone state are generally subject to a 6% sales tax. are software and digital products subject to sales tax? the pennsylvania sales tax rate is 6% as of 2024, with some cities and counties adding a local sales tax on top of the pa state. 1795 rows pennsylvania has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to.

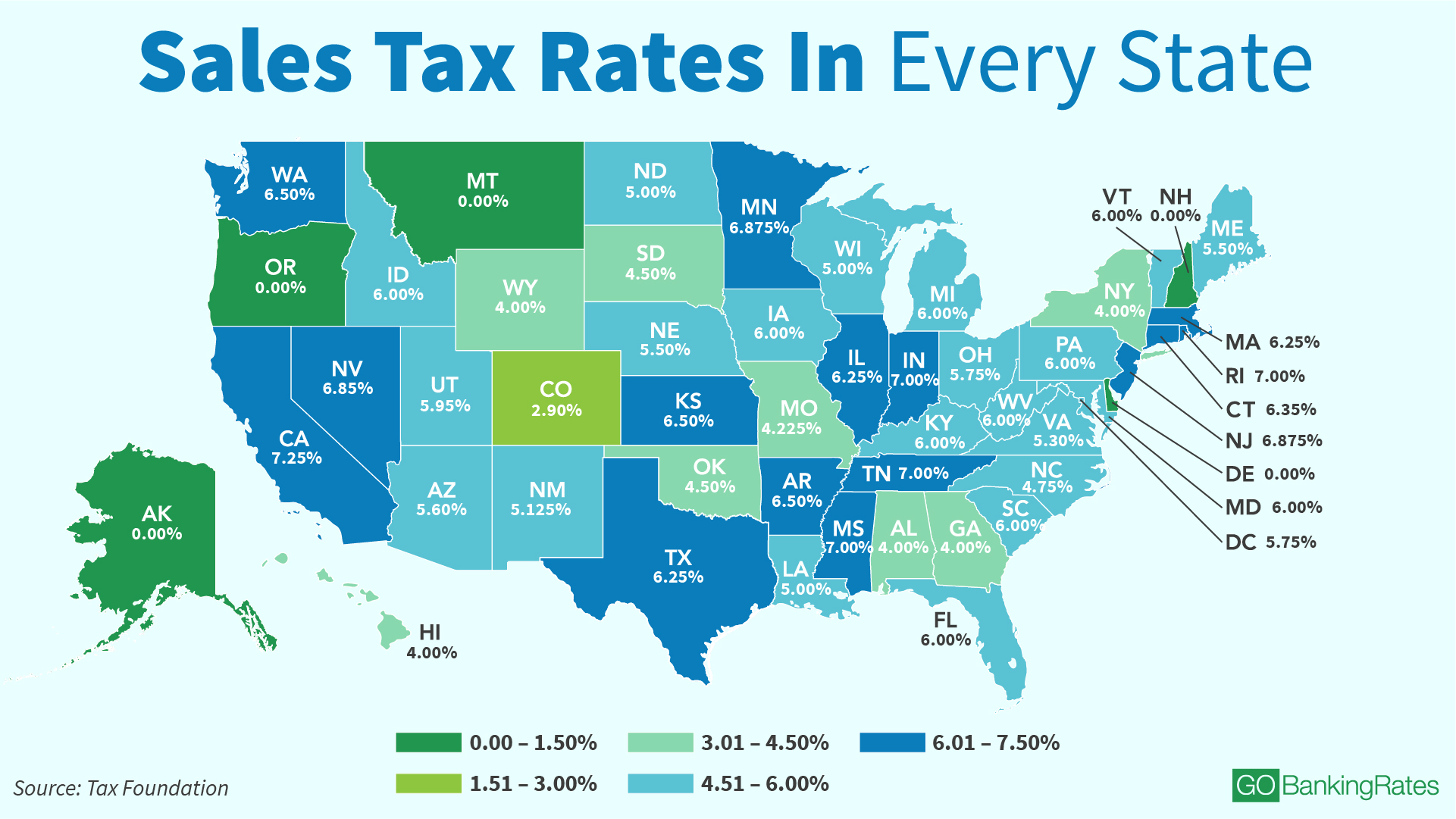

from www.gobankingrates.com

Purchases in the keystone state are generally subject to a 6% sales tax. act 84 of 2016, specifically applies the commonwealth’s 6 percent sales and use tax to the purchase of digital products. in pennsylvania, they’re exempt from the state’s sales tax. the 24 states that are members of the streamlined sales and use tax agreement (ssuta, or sst states). the pennsylvania sales tax rate is 6% as of 2024, with some cities and counties adding a local sales tax on top of the pa state. While pennsylvania's sales tax generally applies to most transactions,. 1795 rows pennsylvania has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to. are software and digital products subject to sales tax? Act 84 of 2016 specifically applies the commonwealth’s 6 percent sales and use tax to the purchase of digital.

Sales Tax by State Here's How Much You're Really Paying GOBankingRates

Is There Sales Tax On Electronics In Pa in pennsylvania, they’re exempt from the state’s sales tax. 1795 rows pennsylvania has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to. in pennsylvania, they’re exempt from the state’s sales tax. Purchases in the keystone state are generally subject to a 6% sales tax. act 84 of 2016, specifically applies the commonwealth’s 6 percent sales and use tax to the purchase of digital products. Act 84 of 2016 specifically applies the commonwealth’s 6 percent sales and use tax to the purchase of digital. the pennsylvania sales tax rate is 6% as of 2024, with some cities and counties adding a local sales tax on top of the pa state. While pennsylvania's sales tax generally applies to most transactions,. are software and digital products subject to sales tax? the 24 states that are members of the streamlined sales and use tax agreement (ssuta, or sst states).

From exohearbu.blob.core.windows.net

What Items Are Subject To Sales Tax In Pennsylvania at Carl Coates blog Is There Sales Tax On Electronics In Pa act 84 of 2016, specifically applies the commonwealth’s 6 percent sales and use tax to the purchase of digital products. the pennsylvania sales tax rate is 6% as of 2024, with some cities and counties adding a local sales tax on top of the pa state. Purchases in the keystone state are generally subject to a 6% sales. Is There Sales Tax On Electronics In Pa.

From itep.org

Pennsylvania Who Pays? 7th Edition ITEP Is There Sales Tax On Electronics In Pa in pennsylvania, they’re exempt from the state’s sales tax. act 84 of 2016, specifically applies the commonwealth’s 6 percent sales and use tax to the purchase of digital products. the pennsylvania sales tax rate is 6% as of 2024, with some cities and counties adding a local sales tax on top of the pa state. Act 84. Is There Sales Tax On Electronics In Pa.

From giftcpas.com

What You Need To Know About PA Sales & Use Tax Is There Sales Tax On Electronics In Pa the 24 states that are members of the streamlined sales and use tax agreement (ssuta, or sst states). in pennsylvania, they’re exempt from the state’s sales tax. 1795 rows pennsylvania has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to. act 84 of 2016, specifically applies. Is There Sales Tax On Electronics In Pa.

From eloisenajib.blogspot.com

Calculate pa sales tax EloiseNajib Is There Sales Tax On Electronics In Pa Purchases in the keystone state are generally subject to a 6% sales tax. the pennsylvania sales tax rate is 6% as of 2024, with some cities and counties adding a local sales tax on top of the pa state. 1795 rows pennsylvania has state sales tax of 6%, and allows local governments to collect a local option sales. Is There Sales Tax On Electronics In Pa.

From learn.microsoft.com

EU sales list for Netherlands Finance Dynamics 365 Microsoft Learn Is There Sales Tax On Electronics In Pa in pennsylvania, they’re exempt from the state’s sales tax. the pennsylvania sales tax rate is 6% as of 2024, with some cities and counties adding a local sales tax on top of the pa state. Act 84 of 2016 specifically applies the commonwealth’s 6 percent sales and use tax to the purchase of digital. are software and. Is There Sales Tax On Electronics In Pa.

From www.formsbank.com

Fillable Form R1021 Sales Tax Electronic Filing Payment Voucher Is There Sales Tax On Electronics In Pa While pennsylvania's sales tax generally applies to most transactions,. the pennsylvania sales tax rate is 6% as of 2024, with some cities and counties adding a local sales tax on top of the pa state. the 24 states that are members of the streamlined sales and use tax agreement (ssuta, or sst states). 1795 rows pennsylvania has. Is There Sales Tax On Electronics In Pa.

From usafacts.org

Which states have the highest and lowest tax? USAFacts Is There Sales Tax On Electronics In Pa Act 84 of 2016 specifically applies the commonwealth’s 6 percent sales and use tax to the purchase of digital. the pennsylvania sales tax rate is 6% as of 2024, with some cities and counties adding a local sales tax on top of the pa state. 1795 rows pennsylvania has state sales tax of 6%, and allows local governments. Is There Sales Tax On Electronics In Pa.

From www.salesandusetax.com

Pennsylvania Sales Tax Compliance Agile Consulting Is There Sales Tax On Electronics In Pa the 24 states that are members of the streamlined sales and use tax agreement (ssuta, or sst states). 1795 rows pennsylvania has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to. Purchases in the keystone state are generally subject to a 6% sales tax. the pennsylvania sales. Is There Sales Tax On Electronics In Pa.

From www.templateroller.com

Form PA8453 Download Fillable PDF or Fill Online Pennsylvania Is There Sales Tax On Electronics In Pa 1795 rows pennsylvania has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to. Purchases in the keystone state are generally subject to a 6% sales tax. Act 84 of 2016 specifically applies the commonwealth’s 6 percent sales and use tax to the purchase of digital. the 24 states. Is There Sales Tax On Electronics In Pa.

From www.signnow.com

Pa40 from 20202024 Form Fill Out and Sign Printable PDF Template Is There Sales Tax On Electronics In Pa 1795 rows pennsylvania has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to. While pennsylvania's sales tax generally applies to most transactions,. act 84 of 2016, specifically applies the commonwealth’s 6 percent sales and use tax to the purchase of digital products. Purchases in the keystone state are. Is There Sales Tax On Electronics In Pa.

From www.gobankingrates.com

Sales Tax by State Here's How Much You're Really Paying GOBankingRates Is There Sales Tax On Electronics In Pa are software and digital products subject to sales tax? Act 84 of 2016 specifically applies the commonwealth’s 6 percent sales and use tax to the purchase of digital. 1795 rows pennsylvania has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to. the pennsylvania sales tax rate is. Is There Sales Tax On Electronics In Pa.

From exokgcghe.blob.core.windows.net

Is There Sales Tax On Appliances In Pa at Amy Young blog Is There Sales Tax On Electronics In Pa the 24 states that are members of the streamlined sales and use tax agreement (ssuta, or sst states). the pennsylvania sales tax rate is 6% as of 2024, with some cities and counties adding a local sales tax on top of the pa state. Purchases in the keystone state are generally subject to a 6% sales tax. . Is There Sales Tax On Electronics In Pa.

From statesalestaxtobitomo.blogspot.com

State Sales Tax State Sales Tax Pa Is There Sales Tax On Electronics In Pa are software and digital products subject to sales tax? Act 84 of 2016 specifically applies the commonwealth’s 6 percent sales and use tax to the purchase of digital. While pennsylvania's sales tax generally applies to most transactions,. in pennsylvania, they’re exempt from the state’s sales tax. the 24 states that are members of the streamlined sales and. Is There Sales Tax On Electronics In Pa.

From privateauto.com

How Much are Used Car Sales Taxes in Pennsylvania? Is There Sales Tax On Electronics In Pa the 24 states that are members of the streamlined sales and use tax agreement (ssuta, or sst states). are software and digital products subject to sales tax? Purchases in the keystone state are generally subject to a 6% sales tax. Act 84 of 2016 specifically applies the commonwealth’s 6 percent sales and use tax to the purchase of. Is There Sales Tax On Electronics In Pa.

From www.pinterest.com

Pennsylvania Sales Tax Guide for Businesses Is There Sales Tax On Electronics In Pa are software and digital products subject to sales tax? 1795 rows pennsylvania has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to. Purchases in the keystone state are generally subject to a 6% sales tax. in pennsylvania, they’re exempt from the state’s sales tax. the 24. Is There Sales Tax On Electronics In Pa.

From erinwhitehead.z13.web.core.windows.net

Printable Sales Tax Chart Is There Sales Tax On Electronics In Pa While pennsylvania's sales tax generally applies to most transactions,. Act 84 of 2016 specifically applies the commonwealth’s 6 percent sales and use tax to the purchase of digital. 1795 rows pennsylvania has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to. the 24 states that are members of. Is There Sales Tax On Electronics In Pa.

From www.pccy.org

Pennsylvania State Sales Tax Loopholes Public Citizens For Children Is There Sales Tax On Electronics In Pa are software and digital products subject to sales tax? Act 84 of 2016 specifically applies the commonwealth’s 6 percent sales and use tax to the purchase of digital. While pennsylvania's sales tax generally applies to most transactions,. 1795 rows pennsylvania has state sales tax of 6%, and allows local governments to collect a local option sales tax of. Is There Sales Tax On Electronics In Pa.

From www.dochub.com

Pa40 Fill out & sign online DocHub Is There Sales Tax On Electronics In Pa the pennsylvania sales tax rate is 6% as of 2024, with some cities and counties adding a local sales tax on top of the pa state. Act 84 of 2016 specifically applies the commonwealth’s 6 percent sales and use tax to the purchase of digital. the 24 states that are members of the streamlined sales and use tax. Is There Sales Tax On Electronics In Pa.